Which of the Following Procedures Best Describes Activity-based Costing

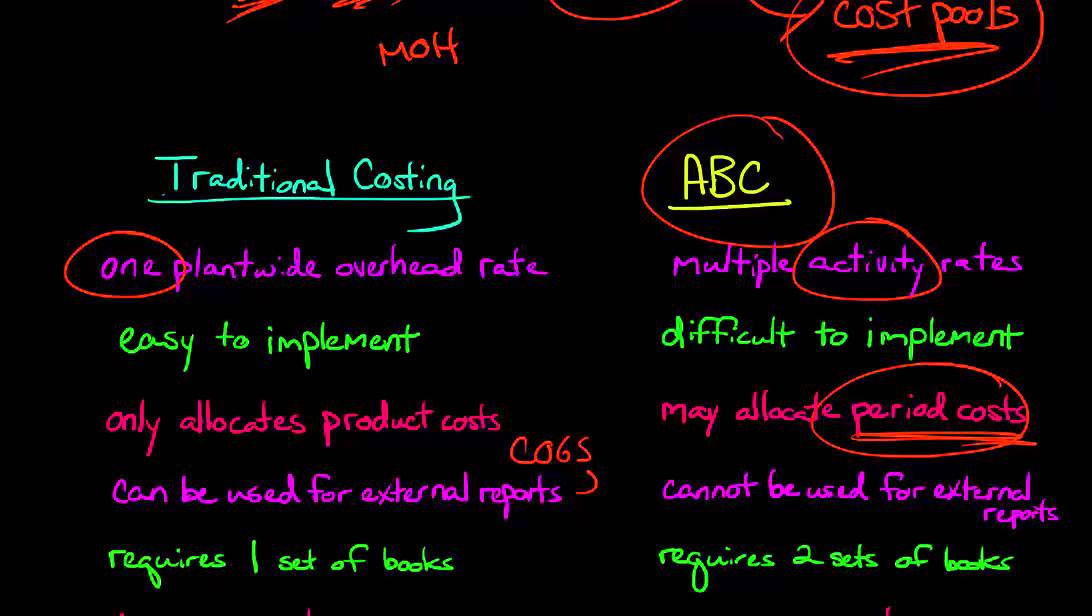

Then costs are assigned to products. Activity-based costs anticipate increased cost pools and increased allocation bases.

Activity Based Costing Principlesofaccounting Com

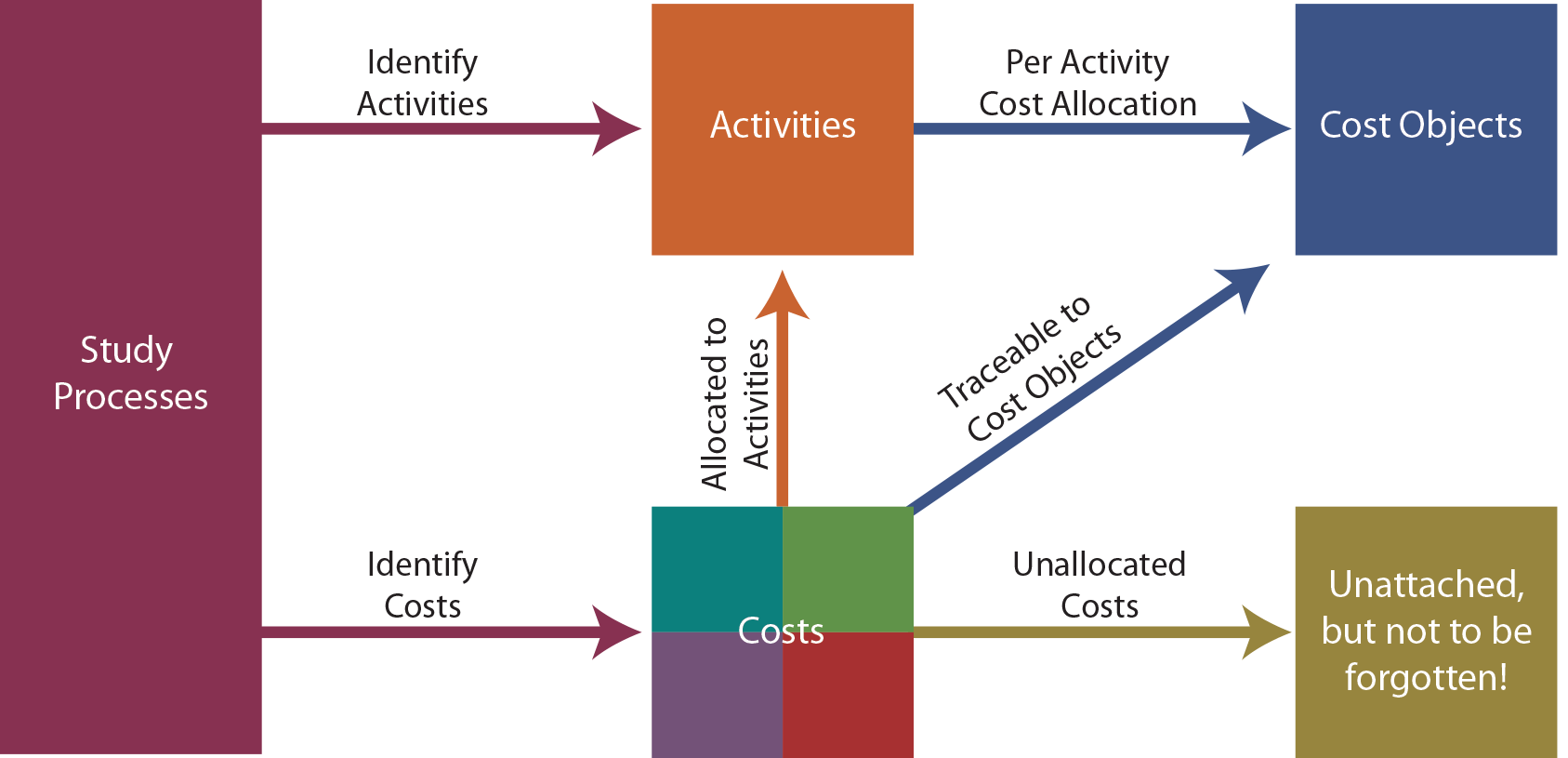

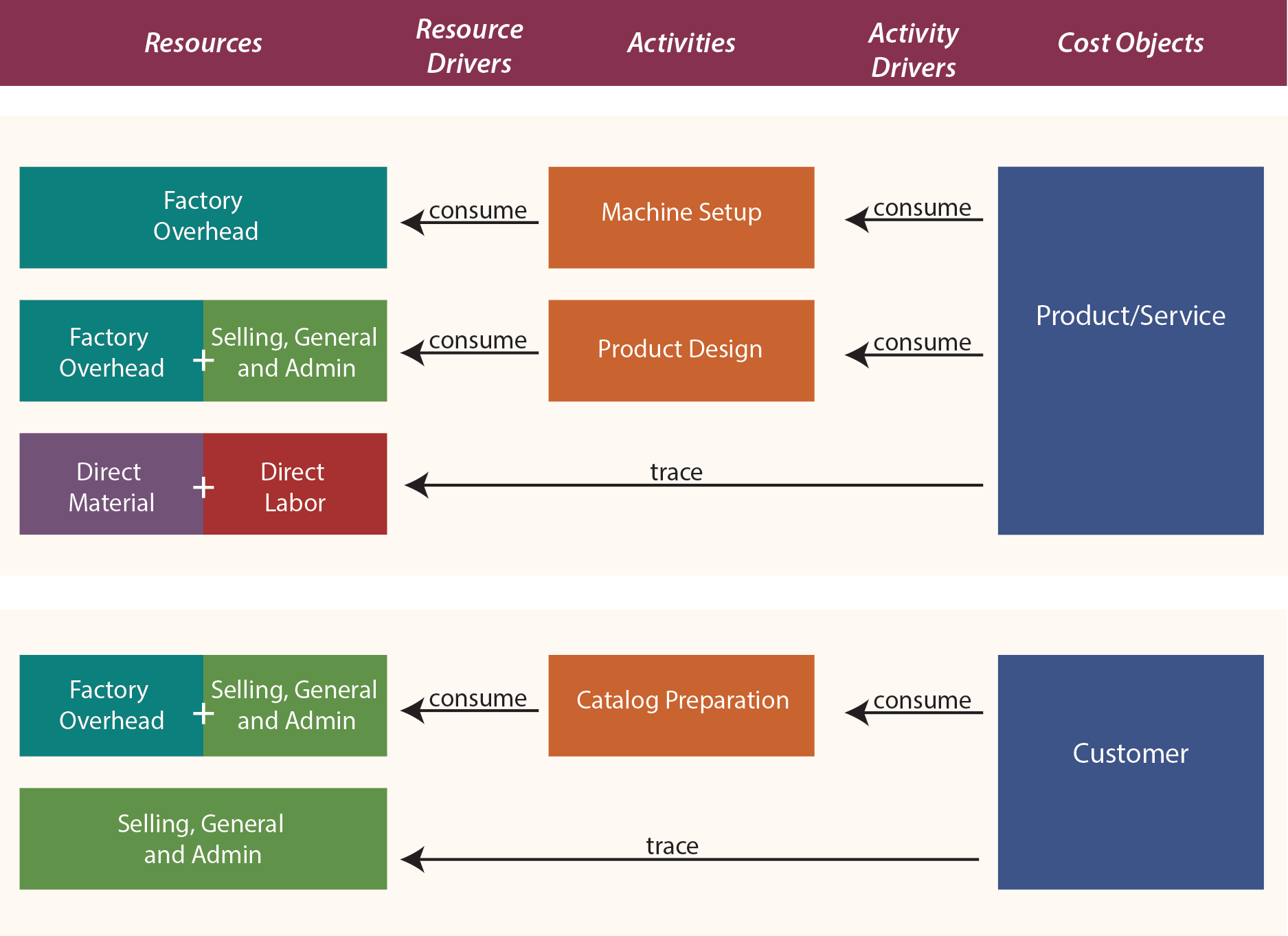

Activity-based costing ABC is a methodology for more precisely allocating overhead costs by assigning them to activities.

. The determination of the amounts that go in these pools and their related cost drivers will likely be more costly than in traditional systems. Activity-based costing is a more specific way of allocating overhead costs based on activities that actually contribute to overhead costs. Then costs are assigned to products.

Activity-based costing removes the use of judgment from the. Identify the cost drivers associated with each activity. Activity based costing can only be used by manufacturing companies.

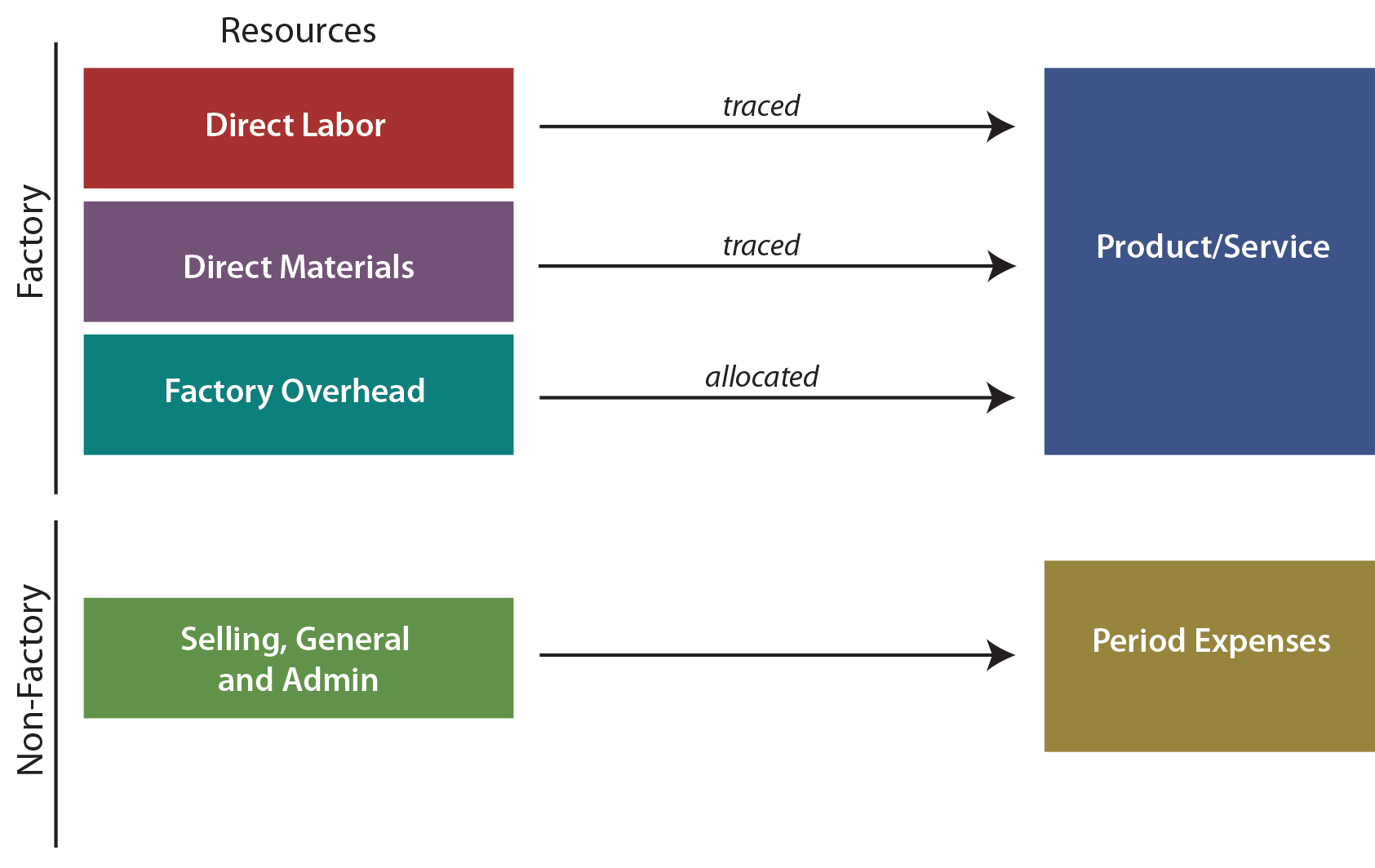

Methods used for activity-based costing. Overhead costs are assigned to departments. Manufacturing businesses with high overhead costs use activity-based costing to get a.

This guide will provide the job order costing formula and how to calculate it. A list of particular activities that are utilized in activity-based costing ABC analysis. The expense of obtaining cost data is relatively high.

All overhead costs are recorded as expenses as incurred. Once costs are assigned to activities the costs can be assigned to the cost objects that use those activities. Then costs are assigned to products.

Which of the following procedures best describes activity-based costing. Activity-based costing provides the most precise product costing information because unlike the other methods it produces information about the activities the quantities of activities and the cost of activities that go into producing a product. Which of the following procedures best describes activity-based costing.

It breaks down overhead costs between production-related activities. It distributes overhead costs into different production-related activities. ABC is a procedure that applies overhead allocation to the products that utilize those activities allowing it to be more exact than traditional allocation.

Activities consume resources and products consume activities. Once we get the the cost driver per unit we will then assigned. An overhead cost-allocation system that allocates overhead to multiple activity cost pools and assigns the activity cost pools to products or services by means of cost drivers that represent the activities used.

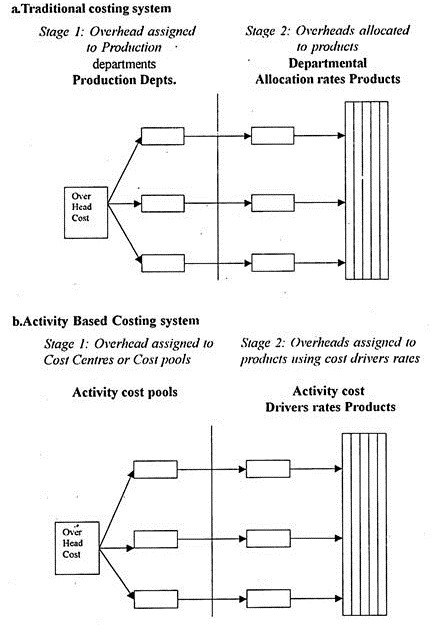

Overhead costs are assigned to activities. ABC is used widely through the two stage costing model. Which of the following procedures best describes activity-based costing.

Activity-based costing is a process for computing production costs. All overhead costs are recorded as expenses as incurred. Job Order Costing Guide Job Order Costing is used to allocate costs based on a specific job order.

A The most widely used approach to activity-based costing involves the use of a two-stage model. C Activity-based costing involves determining the cost of activities. Overhead costs are assigned to activities.

Which of the following procedures best describes activity-based costing. Take note that when we say Activity-based costing ABC this refers to the method which helps to allocate the overhead such as factory utilities depreciation indirect labor and materials based on the provided activities which normally often called as cost drivers purchase orders machine set up and etc. Identify the activities that consume resources and assign costs to those activities.

Then costs are assigned to products. Overhead costs are assigned to activities. Then costs are assigned to products.

D All of the above. Overhead costs are assigned to activities. Activity-based costing ABC is a system you can use to find production costs.

The system can be employed for the targeted reduction of overhead costs. Overhead costs are assigned directly to products. Overhead costs are assigned to departments.

Overhead costs are assigned directly to products. Up to 10 cash back Correct answer. In activity based costing indirect costs including salaries utilities overhead are assigned to activities.

Overhead costs are assigned directly to products. Overhead costs are assigned directly to products. Which of the following is a true characteristic of activity-based costing.

Activity based costing is usually cheaper to implement than traditional volume based costing. B Activity-based costing involves tracing the cost of activities used by the various cost objects. In a two-stage activity-based costing model stage one involves.

The ABC system assigns costs to each activity that goes into production such as workers testing a product. D All of the above AnswerD Rationale. All overhead costs are recorded as expenses as incurred.

Then costs are assigned to products. Activity-based costing requires accountants to use the following four steps. Activity-based costing uses a smaller number of cost pools than does organizational-based costing.

View Final Examdocx from ACCT 6320 at University of Texas Rio Grande Valley. Purchasing materials would be an activity for example. Question 4 of 26 20 20 Points Which of the following procedures best describes activitybased costing.

Then costs are assigned to products. All overhead costs are recorded as expenses as incurred. Overhead costs are assigned to activities.

Which of the following procedures best describes activity-based costing. Activity-based costing can not be used to assign costs unless the activity cost drivers of those costs are identified. Which of the following statements accurately describes activity.

Activity based costing is a system of analysis that identifies and measures the cost of key activities and then traces these activity costs to products or other cost objects based on the quantity of activity consumed by cost objects. The list consists of descriptions of a variety of activities including a.

Activity Based Costing Principlesofaccounting Com

Activity Based Costing Principlesofaccounting Com

Activity Based Costing Meaning Definitions Features Steps Limitations Benefits Uses And Examples

No comments for "Which of the Following Procedures Best Describes Activity-based Costing"

Post a Comment